March 23, 202321, 2024

To Our Stockholders:

You are cordially invited to attend the 20232024 Annual Meeting of Stockholders and any adjournments, postponements, or other delays thereof (the “Annual Meeting”) of Lattice Semiconductor Corporation. For your convenience, we are holding this year’s Annual Meeting virtually.

If you plan to participate in the Annual Meeting, please see the instructions in the accompanying proxy statement (the “Proxy Statement”). Stockholders will be able to listen, vote and submit questions (subject to the question guidelines) from any remote location that has Internet connectivity. There will be no physical location for stockholders to attend the Annual Meeting. Stockholders may participate in the Annual Meeting only by logging in at www.meetnow.global/M7JTJKK.https://meetnow.global/MKJQ5ML.

The attached Notice of Annual Meeting of Stockholders (the “Notice”) and Proxy Statement describe the matters to be acted upon at the Annual Meeting. Included with the Proxy Statement is a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 202230, 2023 (the “Annual Report”). We encourage you to read the Annual Report. It includes our audited financial statements and information about our operations, markets, and products.

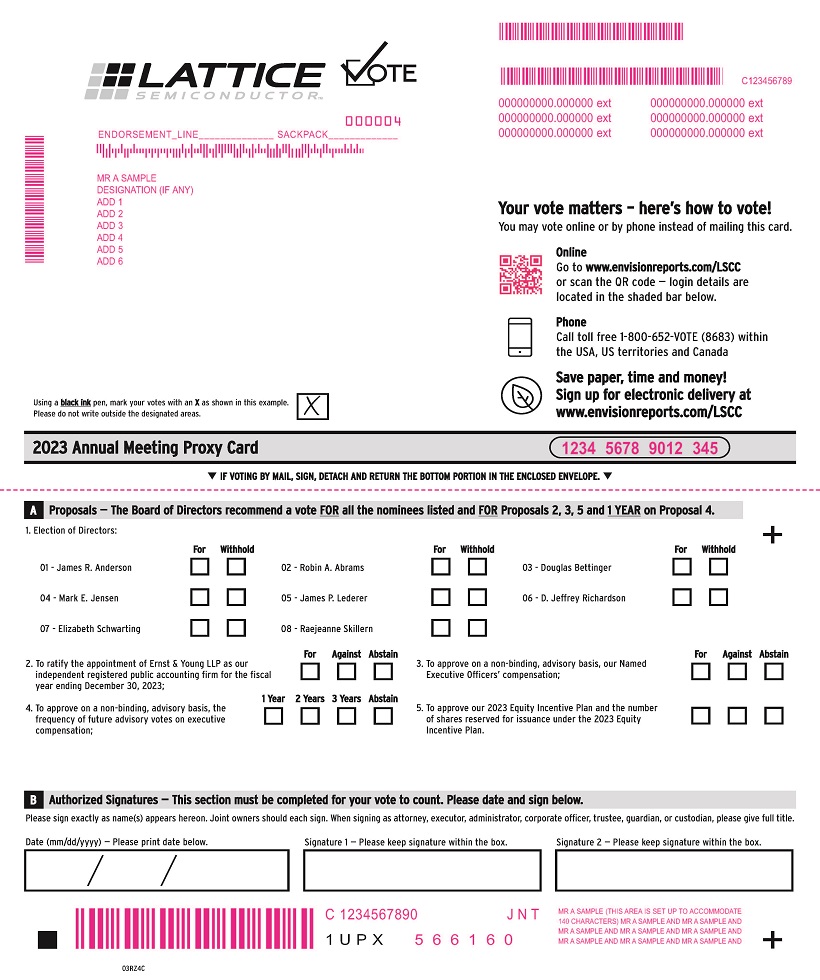

It is important that your shares be represented and voted at the Annual Meeting whether or not you plan to attend. Therefore, we urge you to vote your shares as soon as possible as directed in the proxy materials you receive. A copy of the Proxy Statement and the Annual Report are available online at www.edocumentview.com/LSCC. Please vote in advance of the Annual Meeting by telephone, online or by signing, dating and returning a proxy card to ensure your representation at the Annual Meeting. Voting in advance of the Annual meeting does not deprive you of your right to attend the Annual Meeting and to vote your shares at the Annual Meeting.

Sincerely, |

|

| James R. Anderson Chief Executive Officer |

Whether or not you plan to attend the Annual Meeting, please vote your shares as soon as possible. You can vote your shares by telephone, online or by signing and dating a proxy card and returning it to the address provided on such proxy card. If you receive more than one proxy card because you own shares that are registered separately, then please vote all of the shares shown on all of your proxy cards following instructions listed on each of the individual proxy cards. Thank you.

|